It’s a hot topic on many veterinary management forums – how to choose an alternative financing option for pet owners when traditional third-party financing plans don’t help enough clients. Depending on the demographics of your practice, approval rates for some of the most widely accepted payment options may be too low – and when clients are declined, you’re stuck trying to figure out a way to help your patients get the care they need. Without resorting to deep discounts, writing off services, turning pets away (too painful!), or just resigning yourself to not getting paid, what should you do?

If credit approvals in general are low in your area, your best bet will be to select a professional third-party payment management provider, as an adjunct to your current credit-based financing option. These alternative financing providers keep you and your clients from falling into the “black hole” that is created by a credit denial combined with the client’s inability to pay in full right now, even though they are fully capable of paying over time. Professional payment management companies enable your practice to offer “in-house payment plans” to these clients, while outsourcing the administrative burden of follow-up and collections work. This allows you to achieve much better payment compliance than you would typically get if you’re trying to manage client payments on your own.

There’s a lot to consider when looking at alternative providers. You want to be sure that the financing option you choose benefits your practice by protecting your profit margin and preserving your financial stability, while at the same making it easier for you to help more clients and their pets. But you also want to be certain that the option you choose doesn’t cost you – or your clients – an arm and a leg in fees and/or interest.

My recommendation is that you look into at least 3 different options before choosing an alternative third-party payment management provider. It can sometimes be hard to make an apples-to-apples comparison, because fee structures differ from provider to provider, and some options still require that clients be “approved,” while others don’t. Still others give your practice the freedom to determine approvals based on criteria that you set.

In the end, you will want to choose the solution that is the most cost-effective for your practice; the easiest for your team to learn and “buy into” (would they consider using it themselves? If not, you won’t get buy-in); and the simplest and quickest to implement – meaning you’ll receive the training, tools and support to make a seamless transition, and you will be up and running with the new option as soon as possible.

With those top priorities in mind, here is a checklist of 10 essential things to think about to help you in the decision-making process:

1. Is the provider PCI-compliant? When a provider is PCI-compliant, it means they use the strictest, most up-to-date security protocols for protecting your clients’ private, sensitive financial information. Actually, the complete acronym is “PCI-DSS,” which stands for “Payment Card Industry Data Security Standard.” To learn more about PCI-DSS compliance and why you should care about it, take a look at these FAQs from PCIComplianceGuide.org.

2. Does the provider offer full follow-up and support in the event that a client transaction fails? “Full follow-up and support” means immediate intervention when there’s a problem with a transaction; multiple, frequent methods of client contact; a schedule of escalating communications if clients get behind on payments; and flagging accounts for reporting to credit bureaus. You don’t want a provider that offers just recurring billing services, without a full suite of payment recovery services, too.

3. What is the company’s success rate in collecting payments? Are there any terms or conditions that must be met in order for payments to be “guaranteed” if the client misses a payment or goes delinquent? Guarantees are not always as straightforward as you might expect, and just because a company doesn’t guarantee payments, doesn’t mean you shouldn’t consider doing business with them. Remember that a payment management company’s raison d’etre is to make sure that their customers get paid – and if they don’t do a good job of that, they won’t be in business for long. And speaking of that…

4. How long has the company been in business? Be careful about choosing “pop-up” payment management providers – believe me, they appear all the time when you do an initial Google search, and then three to six months later, you can’t find hide nor hair of their existence. If this information isn’t published somewhere on the company’s web site or in their customer literature, be sure to ask how long they’ve been in business – and verify what you’re told by checking with the BBB.

5. Are there circumstances in which additional fees/interest/penalties come into play? For example, do additional fees apply – payable by you or your client – when a client transaction fails? Are there fees charged if a client’s account goes into collection status (90+ days past due), and if so, how much are the fees, exactly? Is your client charged a penalty for early payoff of their balance? (By the way, this should NEVER be the case. Early payoffs are a good thing for your practice and should not be discouraged because a company wants to make more money. Big red flag.)

6. Is your practice charged any sort of start-up fee, and/or monthly subscription fees? If so, you will want to know exactly how much these fees are. If this doesn’t come up in your conversations with the company, and/or this isn’t information you can find on their web site, ask! And demand nothing less than a clear, specific answer. Also, be sure to find out if you are locked into a contract, or if you are required to send a certain amount of financing contracts to the company during a set period of time (monthly, for example.)

7. What are the fees charged to your client, and are they fair? You don’t want it to be so much that it creates yet another barrier to entry for clients who truly need a payment alternative to traditional credit-based options. The easiest way to determine this is to ask yourself and/or your team members how much they would be willing/able to pay for such a financing option. If it seems unreasonable to you and your team, it will seem that way to your clients, too.

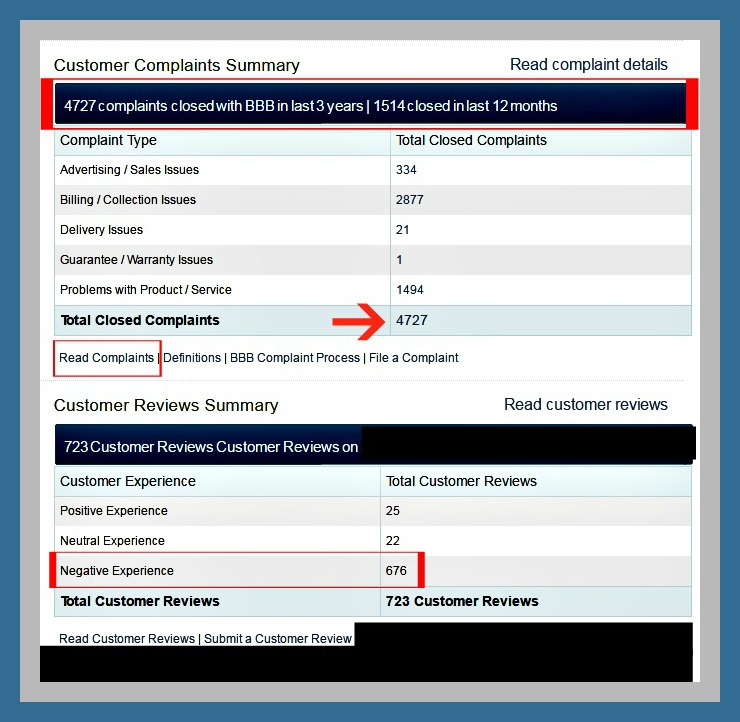

8. What are the CONSUMER reviews like for the company you are considering? Definitely don’t forget to do your homework on this part! The company you use will reflect on your practice, and if clients have negative experiences with your financing company, it will be YOUR reputation at stake at least as much as the finance company’s. You want to work with a business that treats your veterinary clients with the same level of courtesy, respect, and professionalism that you do. After all, this is an extension of your practice that is essentially functioning as your “billing department.” Check out the company’s BBB ratings, Google reviews, reviews on their Facebook page, and also vet them using sites like ConsumerAffairs, Ripoff Report, PissedConsumer, and My3Cents. If you find a bevy of complaints, steer clear.

Below is a BBB report for one of the more commonly used credit-based, third-party financing options in veterinary hospitals. When looking at a BBB report, focus on the complaints and customer reviews summaries. You should also click on “complaint details” for a full explanation of the problem encountered, and the company’s response.

What to look for in a BBB overview: Check complaints and customer review summaries, and read complaint details.

9. Does the company specialize in working with veterinary practices? While it isn’t necessary that they work exclusively with veterinary practices, do you feel the company has a good understanding of the financial needs and challenges of both your business and your clients? What kind of customer support do they offer? Are they readily available to answer questions, help you understand your financial reports, and provide customized solutions in the event that you need one?

10. How much flexibility do you have in terms of tailoring financial solutions to the individual needs of your clients, balanced against the needs of your practice? Are payment options available for any amount, any length of time, on any billing cycle you wish to offer, or is it a “one-size fits all” approach? The more flexibility and control your practice has, the more clients you will be able to help, and the more you will be able to contribute positively to your practice’s bottom line, on terms with which you are comfortable.

I know this is a lot to consider! But if you are seeking alternative financing options for your veterinary clients, you want to put the proper amount of effort into choosing the right company to work with. You only stand to gain from the partnership if you’ve properly “vetted” your potential partner. Your clinic’s ability to help more clients and their pets – and to get fairly compensated for it – is the lifeblood of your practice. So you’ll definitely want to do your homework on this one.