You can educate clients about the value of veterinary services all day long, but if you aren’t also offering flexible payment options that help them manage the cost of that value, pet owners will avoid or delay seeking care for their pet because the perceived financial burden is too great.

There’s been a lot of discussion — for years now — about the importance of effectively communicating to pet owners the value of veterinary services. Helping pet owners understand the value and benefit of veterinary care, it is believed, will increase their willingness to pay for veterinary services.

While this makes some sense – no one is going to seek out, or pay for, services that they don’t value – this premise doesn’t go far enough. Value is only one piece of the equation when it comes to encouraging pet owners to accept recommended treatment options. The price – and affordability – of that treatment – matters a great deal. No one is swayed by value when they plain can’t afford the price.

Think of it this way: most people generally appreciate the value of a luxury car like a Mercedes. This is a car that offers not just luxury, but also best-in-class safety, reliability, quality, and beauty. These features and benefits would be valuable to a lot of people. But that doesn’t increase the likelihood of a purchase if you already know the price tag is beyond your budget.

So, in a similar way, trying to sell pet owners on value, hoping they’ll be more receptive to your treatment plan despite the estimated cost, isn’t likely to be successful – unless you’re also offering payment support options to help them manage the financial burden of the value they’re purchasing.

For over a decade the veterinary profession has known that pet owners are most concerned about the cost of care (remember the Bayer Veterinary Care Usage study from 2011? The findings still very much apply today.) But while this is old news, veterinary practices are still stuck in an old approach to payment. By far the majority of clinics still have policies – and signs on their wall, or warnings on their website — that say, “payment in full is due at the time of service.”

Friends, this is a fantastic way to scare clients away from your practice, if that’s what you want to do. Veterinary prices have outpaced inflation by so much that sticking to that legacy policy should be long dead. Instead, those signs should be replaced with prominent messaging about all the pay-over-time options your clinic offers: CareCredit, Scratchpay, VetBilling, or whatever else you have on tap to help clients overcome the cost barrier.

Do you ever walk into a store that sells “big ticket” items like furniture, appliances, or vehicles, and NOT see tons of signs and brochures about financing? What about the orthodontist’s office? The oral and maxillofacial surgeon?

Why are these signs there? Because these businesses know that to afford what they’re selling, most people can’t pay in full all at once. Without financing options, they’d be selling a lot less of their products and services – even if their customers highly value them.

For some reason the veterinary profession is still way behind the curve when it comes to introducing or accepting novel financing solutions, or even educating clients about existing ones. Doing so is a powerful way to shift the client’s focus from price to value.

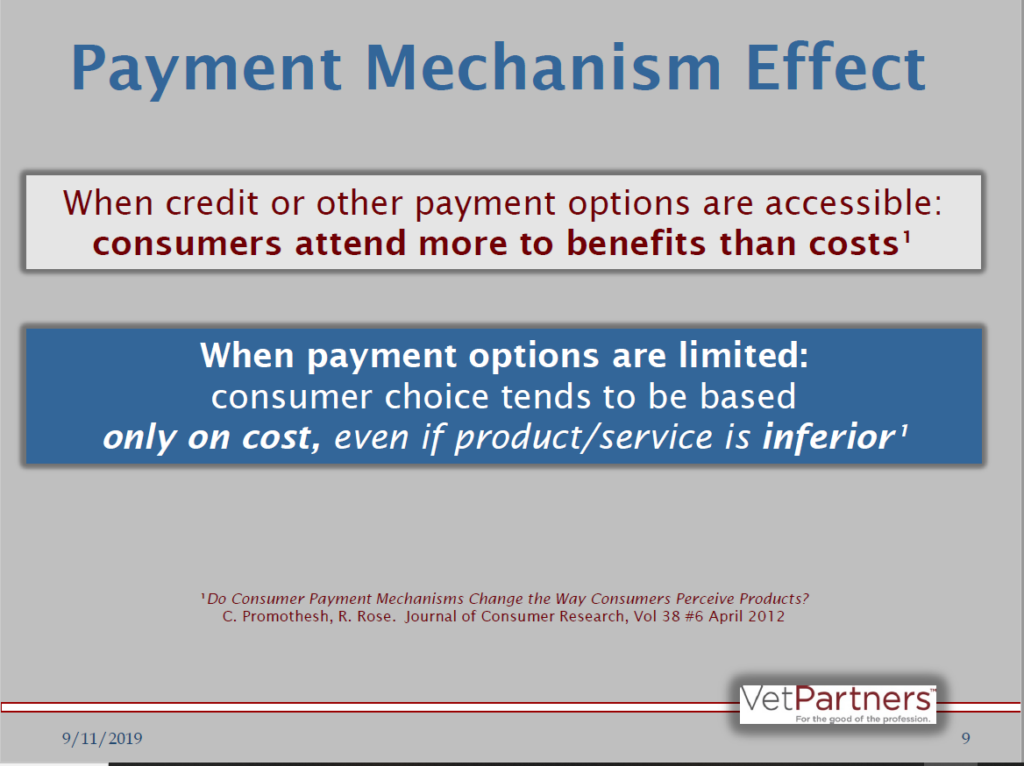

A 2012 study that is salient to this topic examined how “payment mechanisms” affect consumers’ perception of value and their propensity to purchase. A “payment mechanism” is just a fancy academic word for how one pays – in this case, the payment mechanisms were cash or credit.

The results of the study showed that when credit is available, consumers demonstrate an increased propensity to spend when compared to a “cash only” requirement in identical purchase situations. The reason is that the ability to spread cost over time decouples the purchase from the pain of payment.

Even more interesting is the finding that payment mechanisms impact consumers’ perception of the product or service they’re purchasing. When there’s an option to use credit – e.g., pay over time – consumers focus more on the value and benefits of what they’re purchasing. In the absence of a financing option, consumers fixate on cost, and tend to choose an inferior product or service based on price alone.

The predominant veterinary clinic policy of requiring full payment upfront, a transaction which typically caps off a client’s total veterinary experience, can quickly destroy all the goodwill that was earned by compassionate, expert medical care when there is a perception that the hospital is inflexible about meeting the client where he or she is financially. That loss of goodwill then becomes the defining element of the whole experience for the pet owner, and can overshadow any feelings of gratitude and appreciation they have for a job well done by the veterinary team.

Which the team deserves, and then doesn’t get.

Case in point: Our family recently took one of our dogs to the emergency clinic after she decided that eating a tennis ball was a good idea. She needed surgery, of course. While there, I had some time alone with a veterinary nurse and we talked about the issue of cost. She told me, “The only thing you see about us [the hospital] when you read reviews is, ‘they’re all about the money. They don’t care about pets.’ And it really hurts me — I work 16 hours a day, 6 days a week because I love this. I even have my VTS in critical care. I don’t do this for the money – none of us do. We go above and beyond for our patients. But all the clients see is how much it costs, and how unfair it seems that we don’t offer payment options that most clients qualify for. So in the end, it’s almost like what we do for their pets doesn’t matter.”

There is a huge emotional toll exacted on both sides when flexible, accessible payment options aren’t available. Educating about value is important. But helping pet owners find ways to finance that value – and finance it in a way that is reasonable and attainable for “average” people – is equally, if not more, important – even urgent. And not just for pet owners, but for vet teams too.

Sources:Do Payment Mechanisms Change the Way Consumers Perceive Products? Chatterjee, Promothesh and Rose, Randall L. Journal of Consumer Research Vol. 38, No. 6 (April 2012), pp. 1129-1139.

Report on the Economic Well-Being of U.S. Households in 2015: U.S. Federal Reserve, 2016. p. 22

Survey of American Family Finances: The Pew Charitable Trusts. March, 2015.]

How Do Families Cope with Financial Shocks: The Role of Emergency Savings in Family Financial Security: The Pew Charitable Trusts. October, 2015.

Reversing the Decline in Veterinary Care Utilization: Progress Made, Challenges Remain: White paper. American Animal Hospital Association (AAHA), American Veterinary Medical Association (AVMA) & Partners for Healthy Pets. March, 2014.